People Shop conducted an analysis of the current supply chain talent requirements within South Africa.

The survey was based on 563 online job postings from companies across industries during the start of the third quarter of 2022. The research

data highlights the skills demand according to supply chain functions, career levels, provinces and industry sectors.

Data compiled by: Kholofelo Mabila - Data Intelligence Intern

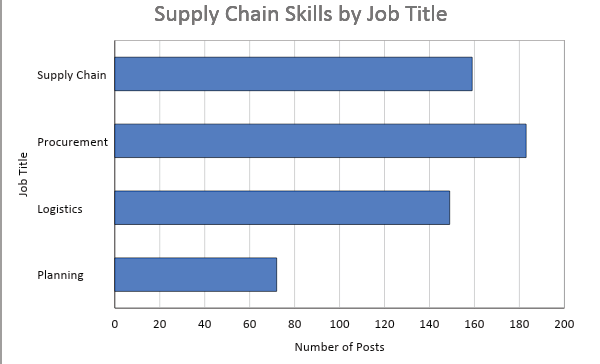

Supply chain functions

The search yielded 563 supply chain management vacancies. The highest demand was procurement (33 percent), followed by supply chain management and operations (28 percent), logistics (26 percent) and the least skills demanded were planning (13 percent).

Digitisation seems to be at the forefront and the main driver of future supply chain skills requirements. The global trends highlight the demand for using business intelligence tools and advanced analytics methodologies to gain real-time insights, which help optimise business process management strategies and evaluate business performance.

There are several different types of data analytics methodologies that companies are leveraging to optimise their supply chain processes. According to Anirudh Bhardwaj, a NextGen Technology Enthusiast, supply chain analytics are categorised into four main types:

Capacity planning – aimed at determining the production capacity of an organisation with respect to changing market demand and balancing between the procurement of raw materials and manufacturing capacity to meet sales demand.

Integrated Business Planning (IBP) – an advanced analytics methodology that mainly focuses on improving financial planning and operational efficiency.

Business intelligence – historical data analytics helps gain insights into the past performance of a supply chain. It includes several crucial parameters such as sales ratios, stock levels, past consignments and inventory turnover.

Demand forecasting – a critical feature of data analytics in supply chain management that incorporates advanced techniques such as predictive analytics, predictive forecasting and data mining to predict future events.

The current research data trends within South Africa do not reflect this digital trend, with the skills demand focused significantly on traditional supply chain roles. Planning roles account for the least demand and the requirement for

advanced analytics within the scope of the roles is also limited.

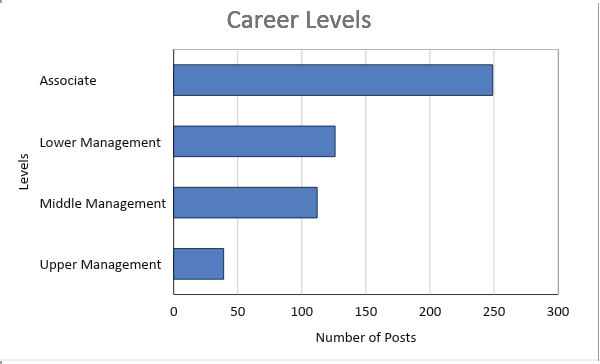

Career levels

Associate/entry-level roles accounted for 47 percent of the posts, followed by lower management/supervisory roles at 24 percent and middle management at 22 percent. Leadership and upper management accounted for 7 percent of the roles in the survey.

Location by province

The location of the vacancies was largely in major cities. Gauteng had the largest number of roles available (49 percent), followed by the Western Cape (24 percent), KwaZulu-Natal (10 percent) and the remaining six provinces accounting for 15 percent. Remote working was at 2 percent, highlighting the change in work approach since the pandemic.

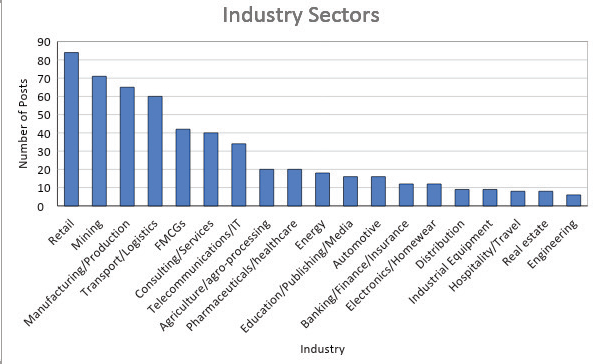

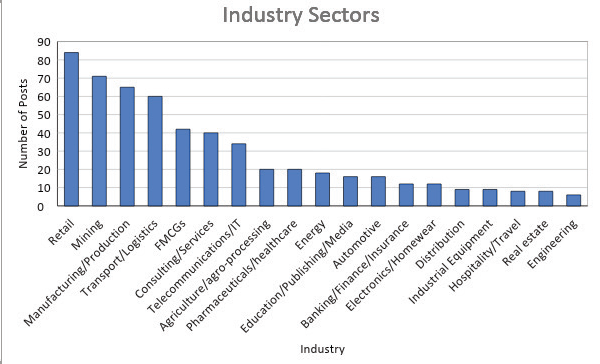

Industries

Each industry is unique with regards to some of the factors driving growth and professional skills that are in high demand. The job posts were grouped into 19 different industries. The top five industries with the highest supply chain skills demand were retail and e-commerce (15 percent), followed by mining (13 percent), manufacturing and production (12 percent), transport and logistics (11 percent) and, finally, fast-moving consumer goods (8 percent). Agriculture and pharmaceutical were grouped separately with 4 percent respectively.

Retail has the largest demand for supply chain skills, split 74 percent physical stores and logistics versus e-commerce roles. According to Stats SA, in South Africa, retail sales growth is expected to trend between 1.8 percent and 2 percent.

In the mining industry, the key drivers of future growth and employment are platinum-group metals (PGMs), manganese and coal mining. These three sectors are projected to aid the industry’s recovery and contribute positively to employment in the industry. The top number of job posts in the mining industry data seem to confirm this as the top companies are involved in the mining of PGMs, coal and manganese.

South Africa’s manufacturing industry is still recovering from the production slump that was caused by COVID-19 in 2020, adverse weather and intensifying electricity disruptions in 2022. The industry shed 249,989 jobs in 2020 and recovered about 41,553 jobs in March 2021. The manufacturing industry reached its lowest PMI in July 2022 and is forecast to continue its recovery throughout this year. Despite the contraction in production, the industry experienced a 19.8 percent growth in jobs with 263,081 new jobs created between December 2021 and March 2022.

The FMCG industry has been very resilient despite supply chain challenges and the impact of rising crude oil prices on packaging, transportation and edible oils. Soaring crude oil prices are forecast to inflate global FMCG prices by 20 to 30 percent. Listed as one of the most attractive industries to work in, the FMCG industry experienced relatively low job losses compared to mining and manufacturing. The industry is expected to grow at a relatively low rate of 1.8 to 2 percent.

According to Statistics SA, inflation in South Africa jumped to a five-year high of 7.4 percent in June 2022, up from 6.5 percent in May 2022. However, since the increase in inflation, South Africa has experienced a steady increase in the formal employment rate beginning in January, which is expected to trend upwards around 39 percent in 2023. The demand for supply chain skills has increased rapidly in the last quarter, which highlights the need for talent and supply chains to drive the economic recovery.

Whilst the formal employment rate is low, the competition for skills remains intense. Businesses seeking to employ top-quality skills must take cognisance of the impact that digitisation has on the supply chain and adapt their recruitment processes accordingly. For job seekers, it’s important to be aware of the volatility that extraneous factors of the last two years have had on the industry and to adapt accordingly.

.jpg)