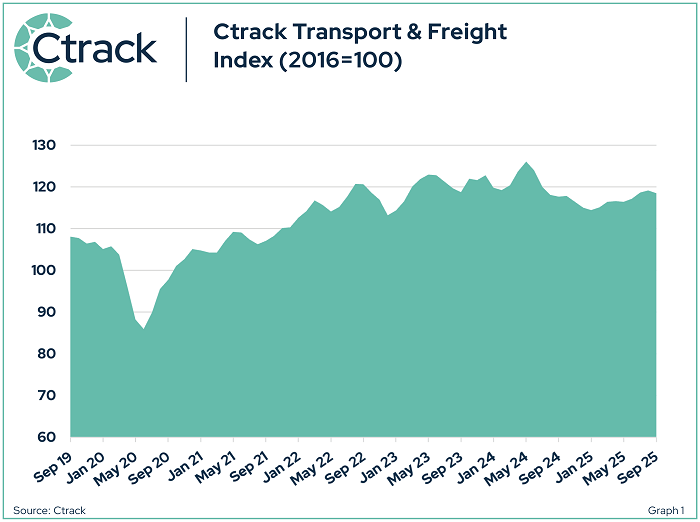

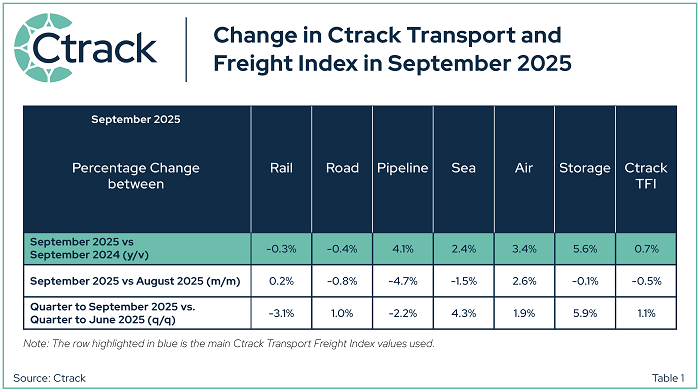

After having reached the lowest level in two years in January 2025, the Ctrack Transport and Freight Index (Ctrack TFI) increased in six of the nine months to September to reach an index level of 118.5, 3.5% higher than in January, but still only 0.7% up on a year earlier.

While only a gradual recovery from multi-year lows, the logistics sector remains in a steady recovery phase, though some sub-sectors are faring better than others. Notable progress on structural reforms to modernise the freight logistics sector has been observed in recent months and are creating a base to support future growth in the industry and the economy at large. Much-needed efficiency gains at ports and the rejuvenation of the rail network will in due course impact the economy positively by reducing transport costs, while enabling robust export growth potential.

GRAPH1: CTRACK TRANSPORT & FREIGHT INDEX (2016=100)

GRAPH1: CTRACK TRANSPORT & FREIGHT INDEX (2016=100)

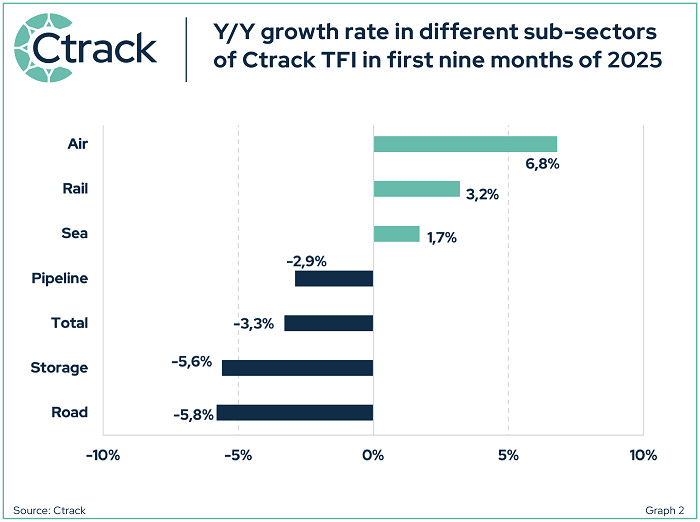

Considering the first nine months of 2025, three sub-sectors contracted compared to a year earlier and three sectors advanced. However, given that the heavy-weighted road freight sub-sector remained under pressure, the overall logistics sector lagged by 3.3% compared to the corresponding period one year earlier - see graph 2. Road freight (-5.8%), transport via pipelines (-2.9%) and the sub-component for storage and handling (-5.6%) contracted, while the air freight (6.8%), rail freight (3.2%) and sea freight (1.7%) sub-sectors recorded growth. While monthly increases were recorded for three consecutive months to August, the Ctrack TFI slipped slightly in September, suggesting that the recovery will not be in a straight line and confirming that the sector is by no means out of woods yet.

GRAPH 2: Y/Y growth rate in different sub-sectors of Ctrack TFI in first nine months of 2025

GRAPH 2: Y/Y growth rate in different sub-sectors of Ctrack TFI in first nine months of 2025

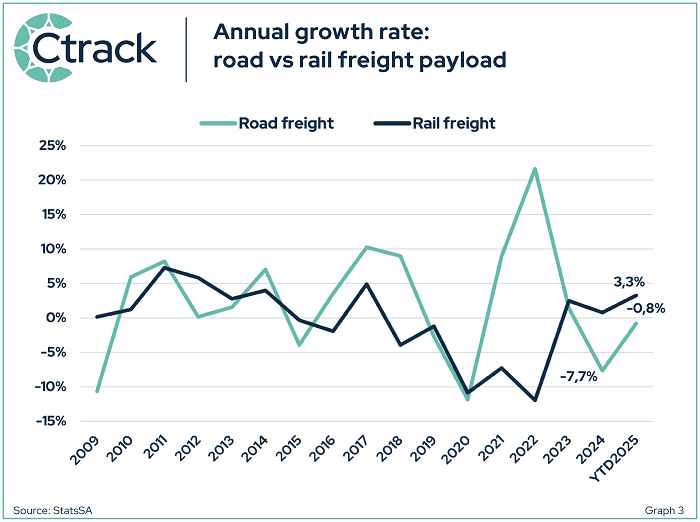

The road freight sector, which accounts for 85.6% of all freight payload in South Africa in the first eight months of 2025, has experienced multiple headwinds since 2023. Among others cross-border delays, serious operational troubles at ports (particularly at the Durban port) and episodes of arson attacks targeting trucks on the N3 in KwaZulu-Natal, often also spreading to Mpumalanga and Limpopo. Government has also recently started to focus on structural reforms to redirect cargoes from road back to rail, although the impact thereof will only likely be notable in the medium term. Still, the cumulative impact of the headwinds resulted in road freight payload increasing by only 1.4% in 2023, after having recorded growth rates of 21.7% and 8.9% in 2022 and 2021, respectively. With the economy still stuck in muddling-along-mode (real GDP growth average of 0.7% in the past 10 years), road freight payload subsequently declined by a notable 7.7% in 2024 and further by 0.8% year-to-date in 2025.

Given all the ongoing challenges the sector is facing, heavy vehicle traffic on the N3 route (large and extra-large trucks) declined by 1.0% in 2024 (vs growth of 0.6% in 2023 and 5.1% in 2022). On a positive note, growth of 3.8% was recorded in heavy vehicle traffic on the N3 in the first nine months of 2025, partly reflecting the improved operational performance of the Durban port. On the contrary, heavy vehicle traffic on the N4 route plummeted by around 20% in the first nine months of 2025 compared to a year earlier, following a contraction of 3.8% in 2024. Especially in 2022 and 2023, at the height of the Port of Durban’s troubles, cargo loads had been redirected towards the Port of Maputo. That trend resulted in heavy vehicle traffic on the N4 route skyrocketing with growth rates of around 57% and 25% in 2022 and 2023, respectively. Thus, the pullback on the N4 route is off an extremely high base.

The logistics sector transformed notably in the past few years, specifically relating to payload moving from rail to road. This has primary been driven by the deterioration and underperformance of rail services offered by Transnet Freight Rail. In its monthly Land Transport data release, Statistics South Africa reports on developments in rail and road freight. From reaching a rock-bottom low of only 9.0% of total freight payload been transport via rail in November 2022, the performance of rail has improved gradually to 14.5% in August 2025 (vs forecast of 14.6% for 2025 as a whole; 14.1% in 2024), though still notably lower than the 10-year average of 22% (2008-2017) reached prior to the onset of the significant deterioration.

The private sector operators have, as could have been reasonably expected, filled the void and road freight boomed in recent years, especially post-Covid. From a percentage of 78.9% in 2017, road freight as percentage of total freight, has gradually moved higher to reach an all-time high of 91.0% late in 2022. Although there are plans on the table to reverse this trend, many obstacles are still in way and it will likely take a considerable period and noteworthy effort to address all the challenges. The latest available data suggests that road freight as percentage of total freight payload was 85.5% in August 2025, comparing to 85.9% in 2024, clearly a very gradual process.

The recovery in the Rail Freight sector is gradual, but on track and likely to see more cargoes moving from road to rail in coming years, as structural reforms gain momentum. A significant driver of government’s logistics reform agenda was the need to arrest the decline in freight volumes as a result of weak operational performance. The implementation of Transnet’s Recovery Plan, which aim to increase the availability and reliability of rolling stock, address the maintenance backlog across the rail network, enhance customer collaboration and reduce security incidents, has been supported by the National Logistics Crisis Committee (NLCC). Transnet’s financial results for the 2024/25 financial year confirm the impact of the recovery interventions that were implemented from 2023. In particular, freight volumes increased to over 160 million tons, reflecting a 5.5% increase compared to prior financial years – reversing the downward trend in volumes, but still falling short on its stated goals. Still, after increasing only marginally in 2024 (0.8% in 2024), growth in rail freight payload increased by 3.3% in the first nine months of 2025 – see graph 3.

GRAPH 3: ANNUAL GROWTH RATE: ROAD VS RAIL FREIGHT PAYLOAD

Operation Vulindlela’s Q2 Phase II progress report, published on 31 October 2025, stated the following notable developments relating to freight logistic reforms:

- Through the publication of the Network Statement (NS) in December 2024, Transnet Rail Infrastructure Manager (TRIM) has made slots available across the freight rail network to private train operating companies (TOCs). Of the 98 applications received, 11 new TOCs have been allocated slots on 41 routes, covering six strategic corridors.

- The Interim Rail Economic Regulator (IRERC) has finalised and submitted its recommendations for the 2025/26 Network Statement and Rail Access Tariff for a determination by the Minister of Transport. This will enable a revised Network Statement and access agreement to be published in early 2026.

- A board has been appointed for the Transport Economic Regulator (TER) to enable its establishment in the 2026/27 financial year.

- The Durban High Court has dismissed an application by a losing bidder to halt the implementation of a partnership for the Durban Pier 2 Container Terminal. This will enable private sector participation to be introduced in South Africa’s largest container terminal, unlocking new investment and management expertise to improve operational performance.

- The Private Sector Participation (PSP) Unit has completed and published its review of responses to the request for information (RFI) released in March 2025 to inform the development of private sector participation projects in the ports and rail system, and is now developing the first Request for Proposals (RFP) that will be issued to the market by Transnet. A further Request for Information (RFI) has been released for passenger rail projects, including fare collection systems; depot management; and long distance regional rapid transit.

- Investment in new equipment has led to improved performance at port terminals, with vessel anchorage down by 75%, higher throughput and reduced container handling times.

While some operational improvements are noted in recent months, South Africa’s ports remain among the worst globally. In the 2024 Container Port Performance Index, Cape Town ranked last (405th), with Ngqura at 404th, Durban at 398th and Gqeberha at 391st – far behind regional peers and reflecting decades of decline. After contracting for two consecutive years, the Sea Freight sub-component increased by 3.4% in 2024 and continued the positive trend with average growth of 1.7% in the first nine months of 2025. Private sector participation, as part of the Freight Logistics Roadmap, intend to address structural inefficiencies and restore critical freight corridors. While implementation challenges persist, renewed fiscal commitment to support Transnet and also the commitment to expand private sector participation are pivotal in revitalising South Africa’s trade-enabling infrastructure and improve logistics performance over the medium term.

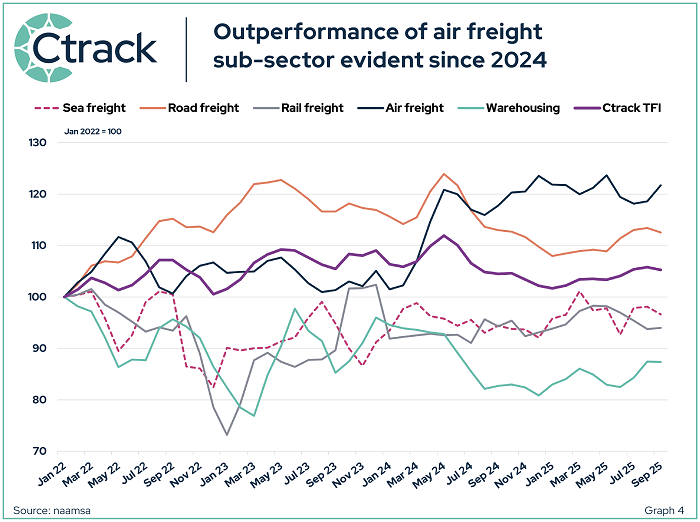

Air Freight continued to be the star performer among other sub-sectors in the first nine months of 2025, aligning with global trends – see graph 4. In September global air freight volumes increased by 2.9% y/y, though a slight deceleration from the stronger-than-expected pace seen in the previous months. This result, however, does not offset the resilient performance of the market seen in recent months, which has benefited from a modal shift and front-loading to avoid tariff implementation, and has registered an expansion for the seventh consecutive month. Cargo demand in Africa kept the momentum and closed the quarter with double-digit growth. September figures showed that cargo demand for carriers in the region increased by 14.7% y/y, over 2.5 percentage points higher than August’s figures, benefiting from strong traffic from Asia. The positive trends extended to South Africa, with total consolidated airport flight movements also increasing by 1.5% y/y in the first nine months, while cargo load on planes in South Africa increased by a further 9.6% in the same period, following on notable growth of 21.9% in 2024. The air freight index increased by 6.8% in the first nine months of 2025 (compared to corresponding period one year earlier), continuing a trend that commenced in 2024.

The Storage and Handling sub-sector of the Ctrack Transport and Freight Index declined by 0.1% in 2024, following two years of larger contractions, with inventory indicators suggesting further pressure in the first nine months of 2025, with a decline of 5.6% recorded compared to the same period in 2024. Similarly, the transport of liquid fuels via Transnet Pipelines (TPL) declined by 1.8% in 2024 (following on a decline of 1.0% in 2023) and started the year mostly in similar trend. Year-to-September a decline of 2.9% was recorded compared to the same period in 2024.

GRAPH 4: OUTPERFORMANCE OF AIR FREIGHT SUB-SECTOR EVIDENT SINCE 2024

The ctrack tfi signals the transport sector’s continuing under-performce relative to overall economy

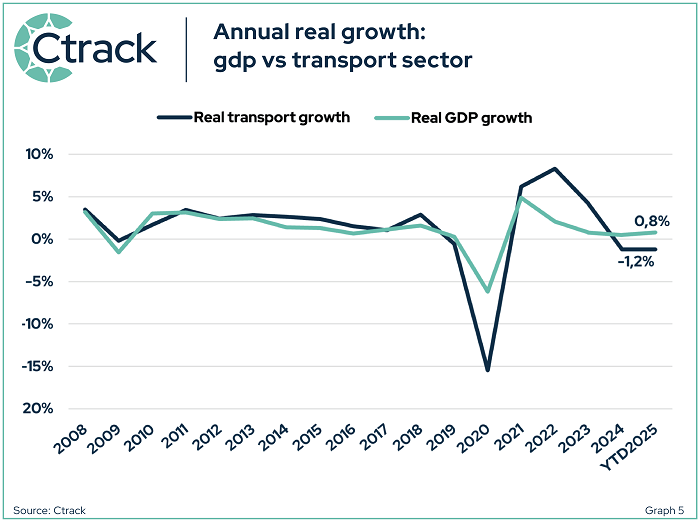

Historically, a fairly good positive correlation was observed between total economic growth and growth in the transport sector. Pre-Covid the sector has regularly outperformed the overall economy, but the sector underperformed notably in 2020, declining by 15.5% vs the overall economy’s contraction of 6.2%. However, the sector bounced back thereafter and returned to a trend of outperformance for three consecutive years. In 2024, however, the sector lost momentum and contracted by 1.2%, a scenario that continued in the first half of 2025 – see graph 6.

GRAPH 5: ANNUAL REAL GROWTH: GDP VS TRANSPORT SECTOR

GRAPH 5: ANNUAL REAL GROWTH: GDP VS TRANSPORT SECTOR

“The steady recovery observed in the broader logistics sector is indeed welcomed. Also, the notable progress on structural reforms to modernise the freight logistics sector. These reforms will in due course impact the economy positively by reducing transport costs, while it should enable robust export growth and facilitate job creation,” says Hein Jordt, Chief Executive Officer of Ctrack.

SUMMARY OF RESULTS

SUMMARY OF RESULTS